The Fed is selling trashury bonds to the pension funds, which are now deep underwater.

reserve

QT and Rate Cuts

QE has started!

Net liquidity Vs. Fed Assets/TGA/Reverse Repo

Net liquidity is now controlling the stock market via the following formula:

Net liquidity = Fed Assets – Treasury General Account – Reverse Repo

Fed Pivot Vs. USD

FOMC Meeting: Huge Rate Hikes

FOMC Meeting: Dot Plot Rises

Treasury General Account Vs. U.S. Dollar

Whenever the U.S. Treasury is out of cash in the Treasury General Account (TGA), additional cash will need to be borrowed by raising the debt limit and monetized by the Federal Reserve. This puts pressure on the U.S. dollar currency.

Fed Allows Bank Dividends and Buybacks

The Fed allows banks to buy back shares and issue dividends amounting to $128 billion from July 2021 onwards. Consider the following. A buyback uses cash on the balance sheet of a company to buy back shares, dissolving them and pushing the share price higher. That cash comes into the hands of shareholders and will start flowing into the economy. This in effect is a stimulus to the economy and pushes up asset and consumer prices.

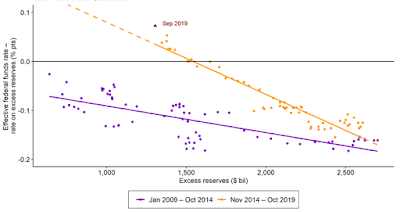

Reserve Balances Vs. IOER

The Reserve Balances at the Fed have been skyrocketing to $4 trillion. The higher this becomes, the higher the IOER needs to be. A hike in IOER is disinflationary as it incentivizes banks to hold more capital at the Fed (IOER serves as a proxy for the fed funds rate).

On the chart below we see that when the excess reserve balance goes higher, either the IOER needs to increase or the Fed Funds Rate needs to decrease.