U.S.

U.S. Mint gold and silver sales exploding

Oil demand growth is slowing down, while gold/silver demand growth is accelerating.

Oil supply is growing, while gold/silver supply is coming down.

The best proxy is the U.S. Mint sales numbers.

Look how gold sales are spiking. We’re hitting sales levels not seen since 2008.

U.S. Debt Hits $18 Trillion

The real picture beneath the strong jobs numbers

Read all of it here.

Belgium’s appetite for U.S. bonds is waning

Who is Mysterious Belgium Buyer of U.S. Debt: Jim Rickards and Peter Schiff’s take

Also Peter Schiff suspects, via his radio show, that it’s the ECB buying U.S. debt via Belgium. He doesn’t suspect it’s the Federal Reserve itself, because that would destroy their credibility of tapering QE.

What is clear is that this is not likely the government of Belgium, or private Belgian capital, that is doing the buying. The numbers are just too large. This is particularly true in the First Quarter of 2014 when the buying averaged a stunning $41.5 billion per month (January was the biggest month with $54 billion). In all likelihood, the only European buyer with a wallet that big would be the European Central Bank (ECB) itself.

GDP Growth Rate Vs. 10 Year U.S. Treasury Bond Yield

So from the chart below: GDP growth (red) should correlate to the 10 year U.S. bond yield (blue).

By monitoring the 10 year U.S. bond yield, you should have a good view on U.S. nominal GDP growth.

Long Term GOFO Rate Hits New Low

Let’s zoom in to 2009-2014: We have a new solid low here.

So not only the short term GOFO rates (1 month to 3 months) are negative now, also the long term GOFO rates are hitting new lows. So there is a tremendous stress building in the gold market. Historically negative GOFO rates are bottoms in the gold price.

This makes me very bullish in gold at this moment. Because gold lease rates are now much higher than the interest rates/bond yields. This indicates to me that the bond market is about to collapse, bond yields will be going higher, because gold lease rates cannot be higher than the corresponding bond yields. Either bond yields will be going up, or gold has to go up. It’s one of the two.

On another note, we see that the Federal Reserve tapering, is actually just talk. Because some entity is buying U.S. bonds via Belgium at a rate of 30-40 billion USD a month, which is exactly how much tapering we have had. The Federal Reserve is throwing sand in our eyes, don’t be fooled. They are propping up the U.S. bond market, artificially lowering the bond yields below the gold lease rates.

|

| U.S. debt held by Belgium (Billion USD) |

Why Belgium is Buying so Much U.S. Bonds

For what I know, the Fed could even be buying its own U.S. bonds via Belgium.

If this is true, then the Fed isn’t tapering at all if you count the numbers…

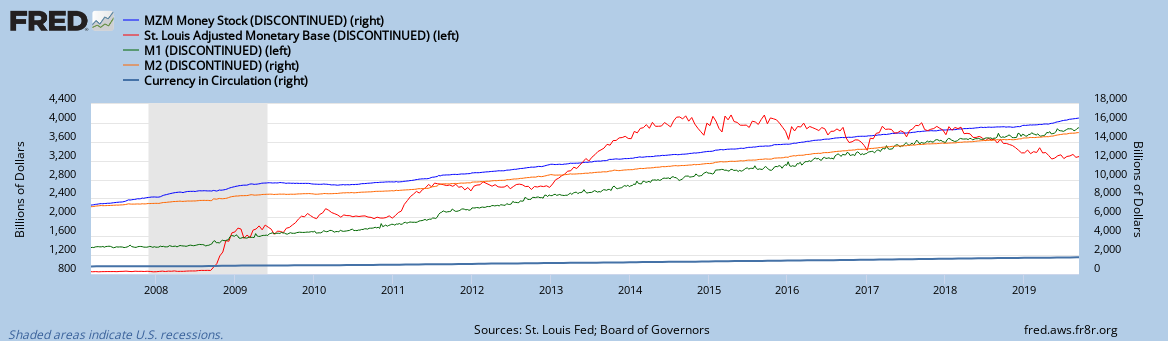

Because why is base money supply (red chart) growing at an even higher pace?

Creditor Name: Belgium

Amount of U.S. Debt Owned (January 2013): $143.5 billion

Percent of U.S. Public Debt (January 2013): 1.24 percent

We know what you’re thinking: Belgium? Really? The gross domestic product (GDP) of this small European nation tucked between France, Germany and the Netherlands ranks No. 32 in the world, behind Nigeria and Malaysia [source: CIA World Factbook]. So why is Belgium one of the top 10 purchasers of U.S. debt?

The secret is something called “custodial bias” [source: U.S. Treasury]. Belgium has made a name for itself as one of Europe’s most vibrant international banking centers. Like Switzerland, bank accounts in Belgium historically offered a high degree of secrecy, although that changed in 2011 when the Belgian government began disclosing account information to improve tax transparency [source: Hyslop]. Still, Belgium offers big tax breaks for foreign companies that create Belgian subsidiaries and benefits for investors who choose Belgium for offshore accounts [source: Henley].

Belgium’s status as a tax haven makes it a popular place to buy U.S. debt, even if the investors aren’t from Belgium. The U.S. Treasury tracks purchases of U.S. debt by geographic origin, not the specific nationality of the buyer [source: U.S. Treasury]. This is where custodial bias distorts the debt figures. Belgium is a custodian (or holder) of U.S. debt from investors living in nearby France and Germany or as far away as China and Japan. How much of that debt is owned by actual Belgians is difficult to tell.

We’ll talk more about custodial bias with our next entry: teeny tiny Luxembourg.

Belgium Buys Another Load of U.S. Treasuries

|

| Foreign U.S. debt holders |

Look how much they bought, starting from November 2013.

|

| U.S. debt held by Belgium |

I have no idea why they are doing this. That the ECB would buy U.S. treasuries to get the euro down, maybe. But why is Belgium buying so much U.S. treasuries? $50 billion accounts for 10% of Belgium GDP. Can they support this?

We see Belgium’s own public debt has been rising since the crisis. Instead of using the money for servicing its own debt, they buy U.S. debt.

|

| Debt to GDP Belgium |

Let’s look at Belgium’s treasury yields. The 10 year is at 2.2%, which is below the 2.7% of U.S. Nothing much to see here, but look what happens in November 2013. Yields on U.S. treasuries are going up. Do you remember what happened then?

Yes, the Chinese came out saying they will stop buying U.S. debt. So who goes to the rescue? Belgium.

|

| Belgium 10 Year Yield |

|

| U.S. 10 Year Yield |

Probably Belgium is the heart of Europe as Europe started from Belgium. These European people want to support the U.S.

But actually, I think being in U.S. treasuries isn’t such a bad idea at this moment. When stocks collapse, U.S. treasuries are pretty safe.What I’m worried about though, is that the U.S. dollar is now starting to collapse. The dollar cash index is moving towards 70, when Belgium holds all of these U.S. treasuries, it will realize losses on the U.S. dollar currency value. A 10% loss in currency value, means at least a $30 billion dollar loss for Belgium and I heard that they even bought U.S. treasuries that the Russians dumped in March 2014. These are dangerous things to do.

For more info, here is a link to Zerohedge.