Japan is undergoing a lot of changes today and one of the most important changes to investors is their fiscal situation. In a previous post almost a year ago, I analyzed the dismal fiscal situation in Japan, pointing out how their budget deficits and debt burdens are growing. I want to make an update on that as investors are focusing more and more on Japan these days.

The Ministry of Finance Japan has issued a new report on the fiscal situation which can be found here. This report is dated from December 2013.

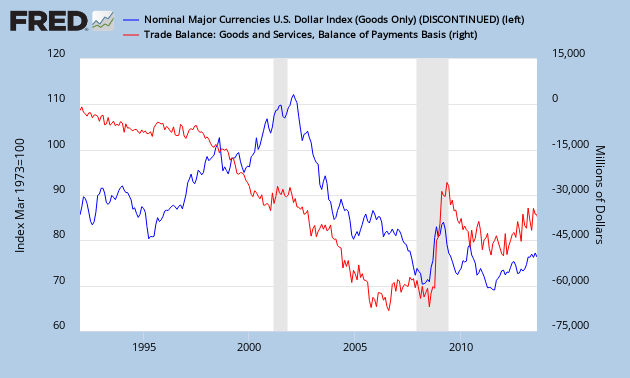

Let’s first focus on the trade and current account deficit in Japan. Both have been deteriorating rapidly in 2013. In fact, we are hitting new lows as we speak. The primary reason is that the yen has devalued a lot since 2013. As I noted earlier in other posts, the currency valuation is correlated to the deficit. If the valuation of the currency of a country goes down, that means that they will need to import products at a higher price and they will export products at a lower price. This naturally leads to a higher deficit. Evidence can be found in the soaring costs for importing oil to Japan. Oil imports basically almost doubled in price as noted in this article.

If we then move on to the budget deficits, there is a bit of light at the end of the tunnel. The deficit to outlay ratio (which gives the likelihood for hyperinflation) has come down from a peak of 62% to 48% which is an improvement, but we are still in hyperinflationary territory (ratio above 40% is hyperinflationary).

Chart 3 illustrates that the government has cut back on spending (red chart) and the budget deficits have come down (green chart). It also shows how tax revenues in Japan (blue chart) have gone up due to a rising Japanese stock market. This rise in tax revenues has decreased the budget deficits in Japan.

Now we come to the most interesting part of this analysis: the interest payments on government debt. To find out about this, go here.