Let’s look at the facts and figures. The reality is that many indicators are pointing to a weakening economy. To read the analysis, go here.

bonds

Crude Oil Vs. Junk Bonds

As you can see, the trend is there, but not too pronounced. But lately, after 2008, the energy junk bond market (lead by the oil price) is leading the total junk bond market lower. So plunging oil prices have negative consequences on junk bonds. And lower junk bond prices will eventually lead to a stock market crash.

Conclusion: declining oil prices and higher stock markets are impossible.

For more info, go here.

Junk Bonds Vs. Stock Market

This is why we need to keep an eye on high yield debt (blue chart). Since the second half of 2014, this high yield debt has collapsed. Soon, the stock market (red chart) will follow.

Belgium’s appetite for U.S. bonds is waning

Bank Deposit Vs. Interest Rate

Whenever yields are low, be it that the government lowers interest rates or imposes taxes on deposits. The result is that people will flee out of bank deposits and move their money either into equities or gold. Or anything else for that matter. This is because investors are searching for yield on investment. If interest rates are low, they will find a better use for their money than putting it in a bank.

Take Spain for example. Ever since the treasury yields peaked out in 2012, the same happened in the bank deposits in Spain.

|

| Spain 10 Year Yield |

As you can see here, the peak in Spain deposits (green chart) can also be found in 2012.

|

| Eurozone deposits |

Gold Vs. Equities Vs. Bonds

Why Belgium is Buying so Much U.S. Bonds

For what I know, the Fed could even be buying its own U.S. bonds via Belgium.

If this is true, then the Fed isn’t tapering at all if you count the numbers…

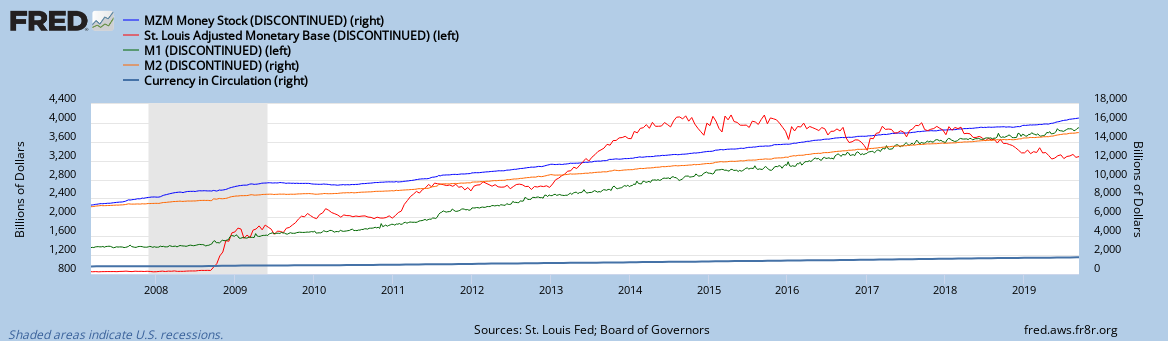

Because why is base money supply (red chart) growing at an even higher pace?

Creditor Name: Belgium

Amount of U.S. Debt Owned (January 2013): $143.5 billion

Percent of U.S. Public Debt (January 2013): 1.24 percent

We know what you’re thinking: Belgium? Really? The gross domestic product (GDP) of this small European nation tucked between France, Germany and the Netherlands ranks No. 32 in the world, behind Nigeria and Malaysia [source: CIA World Factbook]. So why is Belgium one of the top 10 purchasers of U.S. debt?

The secret is something called “custodial bias” [source: U.S. Treasury]. Belgium has made a name for itself as one of Europe’s most vibrant international banking centers. Like Switzerland, bank accounts in Belgium historically offered a high degree of secrecy, although that changed in 2011 when the Belgian government began disclosing account information to improve tax transparency [source: Hyslop]. Still, Belgium offers big tax breaks for foreign companies that create Belgian subsidiaries and benefits for investors who choose Belgium for offshore accounts [source: Henley].

Belgium’s status as a tax haven makes it a popular place to buy U.S. debt, even if the investors aren’t from Belgium. The U.S. Treasury tracks purchases of U.S. debt by geographic origin, not the specific nationality of the buyer [source: U.S. Treasury]. This is where custodial bias distorts the debt figures. Belgium is a custodian (or holder) of U.S. debt from investors living in nearby France and Germany or as far away as China and Japan. How much of that debt is owned by actual Belgians is difficult to tell.

We’ll talk more about custodial bias with our next entry: teeny tiny Luxembourg.

Belgium Buys Another Load of U.S. Treasuries

|

| Foreign U.S. debt holders |

Look how much they bought, starting from November 2013.

|

| U.S. debt held by Belgium |

I have no idea why they are doing this. That the ECB would buy U.S. treasuries to get the euro down, maybe. But why is Belgium buying so much U.S. treasuries? $50 billion accounts for 10% of Belgium GDP. Can they support this?

We see Belgium’s own public debt has been rising since the crisis. Instead of using the money for servicing its own debt, they buy U.S. debt.

|

| Debt to GDP Belgium |

Let’s look at Belgium’s treasury yields. The 10 year is at 2.2%, which is below the 2.7% of U.S. Nothing much to see here, but look what happens in November 2013. Yields on U.S. treasuries are going up. Do you remember what happened then?

Yes, the Chinese came out saying they will stop buying U.S. debt. So who goes to the rescue? Belgium.

|

| Belgium 10 Year Yield |

|

| U.S. 10 Year Yield |

Probably Belgium is the heart of Europe as Europe started from Belgium. These European people want to support the U.S.

But actually, I think being in U.S. treasuries isn’t such a bad idea at this moment. When stocks collapse, U.S. treasuries are pretty safe.What I’m worried about though, is that the U.S. dollar is now starting to collapse. The dollar cash index is moving towards 70, when Belgium holds all of these U.S. treasuries, it will realize losses on the U.S. dollar currency value. A 10% loss in currency value, means at least a $30 billion dollar loss for Belgium and I heard that they even bought U.S. treasuries that the Russians dumped in March 2014. These are dangerous things to do.

For more info, here is a link to Zerohedge.

Belgium Buys Chinese U.S. Bonds

|

| U.S. bond holders |

Buying Japan is Picking Flowers in Front of an Incoming Train

Japan is undergoing a lot of changes today and one of the most important changes to investors is their fiscal situation. In a previous post almost a year ago, I analyzed the dismal fiscal situation in Japan, pointing out how their budget deficits and debt burdens are growing. I want to make an update on that as investors are focusing more and more on Japan these days.

The Ministry of Finance Japan has issued a new report on the fiscal situation which can be found here. This report is dated from December 2013.

Let’s first focus on the trade and current account deficit in Japan. Both have been deteriorating rapidly in 2013. In fact, we are hitting new lows as we speak. The primary reason is that the yen has devalued a lot since 2013. As I noted earlier in other posts, the currency valuation is correlated to the deficit. If the valuation of the currency of a country goes down, that means that they will need to import products at a higher price and they will export products at a lower price. This naturally leads to a higher deficit. Evidence can be found in the soaring costs for importing oil to Japan. Oil imports basically almost doubled in price as noted in this article.

|

| Chart 1: Japan Current Account and Trade Balance |

If we then move on to the budget deficits, there is a bit of light at the end of the tunnel. The deficit to outlay ratio (which gives the likelihood for hyperinflation) has come down from a peak of 62% to 48% which is an improvement, but we are still in hyperinflationary territory (ratio above 40% is hyperinflationary).

|

| Chart 2: Deficit to Outlay Ratio Japan |

Chart 3 illustrates that the government has cut back on spending (red chart) and the budget deficits have come down (green chart). It also shows how tax revenues in Japan (blue chart) have gone up due to a rising Japanese stock market. This rise in tax revenues has decreased the budget deficits in Japan.

|

| Chart 3: Japan: Tax Revenue, Expenditures, Budget Deficit |

Now we come to the most interesting part of this analysis: the interest payments on government debt. To find out about this, go here.