A huge inflow was seen yesterday at the COMEX in registered gold and I mean huge. We haven’t seen these kind of numbers since 2013.

My correlations suggest that the GLD ETF is seeing the same inflows when this happens and I checked GLD yesterday and yes, we saw another 10 tonnes of gold inflows at the start of the month of June 2016. This bodes very well for the price of gold.

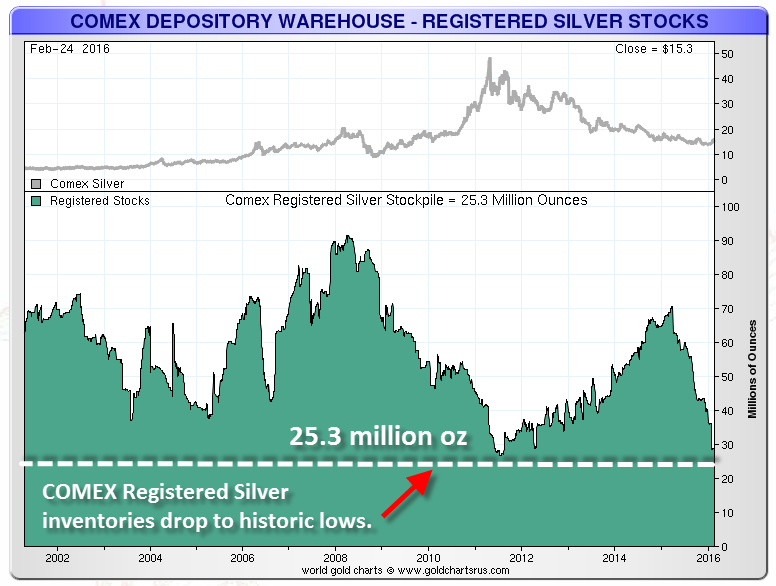

For silver we see continued tightening in physical silver. I expect to see silver explode in a month or two from now when the blue line intersects with zero.