Month: November 2019

Silver is about to explode

Divergence in Misery Index and Gold

Either misery is going to increase or gold is going to go down. I believe misery is going to go up.

First off, the unemployment rate is going to rise as nonfarm payrolls have been declining.

Second, inflation should be going up in time due to QE of the Fed and massive amounts of debt financing and budget deficits. The trade war is also not resolved yet. Productivity has been going down with industrial production and manufacturing all declining, which will lead to higher inflation.

So the misery index will be going higher and that will also mean that P/E ratios will come down together with stock valuations. Gold will be going higher.

J.P. Morgan Pledged Gold Comex

China Power Consumption / China GDP Vs. Gold Price

China power consumption improving

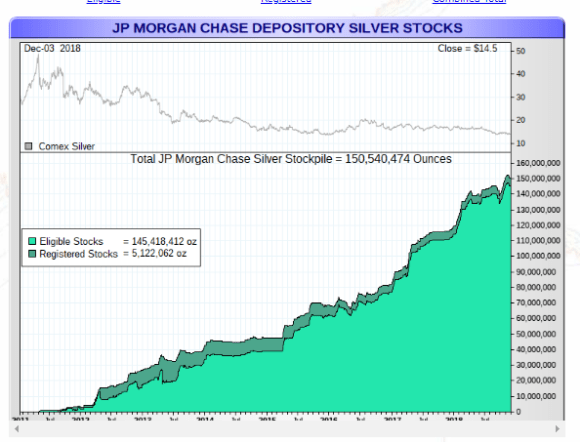

China Whale Keeps Buying Silver

COMEX registered silver: September 2019 is a Turning Point

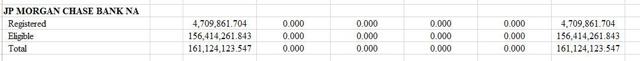

J.P. Morgan registered silver at COMEX went down begin September 2019.

So something happened in September 2019 and they are panicking. Which can be seen from the spike in open interest in September 2019.

Monetary Base Vs. Gold Reserves

J.P. Morgan Registered Silver Stock at COMEX is declining