For more info on interest rates see: http://www.federalreserve.gov/econresdata/feds/2015/files/2015010pap.pdf

Interest

Negative Interest Rates: First ECB, now SNB

All of this is because the yield curves are flattening, and yields cannot be too close to each other, or we get a recession.

The effect of this drop in deposit rates should be that eventually investors remove their money from those banks and invest it in something else. Lending and spending will increase and the bubble becomes an even bigger bubble.

I do not need to tell you this is good for gold. In fact, denying the Swiss gold referendum is actually bullish for gold as the SNB can do whatever it wants now…

1) Yields go down due to lower interest rates.

2) CPI goes up through inflating the bubble.

This is why interest rates can’t be raised

Because when we arrive at 2015, the long term bond yields (red and blue chart) will have almost intersected with the short term treasury bills (purple chart). We call this flattening of the yield curve.

If Janet Yellen even increases its interest rates half a percent, the 2 year treasury yields will skyrocket. The yield curves will flatten out and a recession will start, just like in 2008 where the yield curves were flat.

Note: A flattened yield curve means that all maturities (3 month, 2 year, 5 year, 10 year, 30 year bonds) have the same yield. This is typically a recessionary indicator.

Look how the 2 year bond yields go up because of Janet Yellen’s talk about increasing interest rates.

|

| 2 year U.S. bond yields |

The effect of ECB negative deposit rate

Who would want to hold deposits with negative rates? They will of course take their money out and hunt for higher yielding assets.

See what happens to the deposits of the periphery in Europe on this chart:

Why the Federal Reserve Cannot Increase Interest Rates

A very interesting chart from Mish Shedlock. You can see that the Federal Reserve can never raise interest rates as it will spike the interest payments on its debt from the current $400 billion, which can be found here, to over $1 trillion.

|

| Interest Impact Comparison |

As you know, the tax revenues are only $3 trillion at this moment. If interest payments go to $1 trillion, the interest payment as a percentage of tax revenues will go over 30%. Which is even worse than Japan’s 25% today. On top of these interest payments, we have several spending programs which will result in a total spending of more than $4 trillion. $4 trillion minus $3 trillion is a 1 trillion deficit/year at least.

This means, the Federal Reserve cannot ever increase interest rates. Especially when tax revenues will come down due to the low savings rate and high real unemployment.

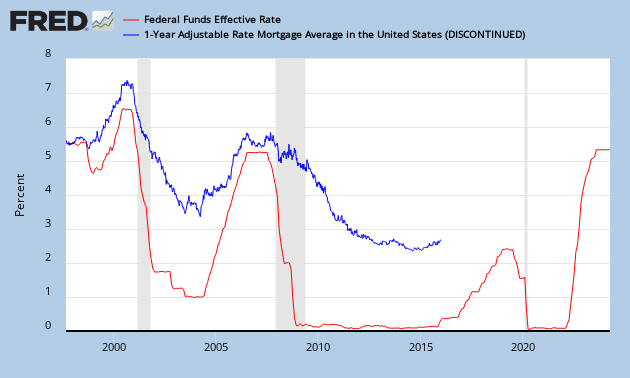

Not to mention what would happen to adjustable mortgage rates and the housing market, where everyone is now using adjustable rate mortgages to profit from low rates. Knowing this, we will always have negative real interest rates as inflation will be kept at 2% and nominal interest rates at 0%. A great environment for precious metals.

Interest payments as a percentage of tax revenue: Fiscal Year 2013

As fiscal year 2013 passes by we note that the interest payments as a percentage of tax revenue has declined over the past year (Chart 1: red line). The number came in at 13% and wasn’t due to a decrease in interest payments.

|

| Chart 1: Interest Payments |

As a matter of fact, the interest payments went up this year due to higher debt and higher interest rates (Charts 2 and 3).

|

| Chart 2: U.S. Debt Vs. Interest Payments |

|

| Chart 3: 10 Year U.S. Bond Yield Vs. Interest Payments |

The reason why we see a decline in the interest payment to tax revenue ratio is because of the huge increase in tax revenues the government received this year (Chart 4).

|

| Chart 4: U.S. Government Tax Revenue |

This was all due to a tax increase at the start of 2013 (Chart 5: blue line), which plunged the savings rate (Chart 5: red line) of households.

|

| Chart 5: Tax Revenue Vs. Savings Rate |

All in all a pretty positive year for the U.S. budget.

Marc Faber In Thailand, Talking About Clowns

Marc Faber at a Thai studio.

QE As Far As The Eye Can See

Federal Reserve: To Taper or not to Taper

|

| Chart 1: U.S. Public Debt |

Since May 19, 2013, the debt ceiling has been stuck at $16.735 trillion and this ceiling has been in place for almost 2 months as chart 1 suggests. The treasury says that they would be able to pay all the bills until October by enacting extraordinary measures from May 20 till August 2.

In all, the Treasury has the following measures available to it:

- Suspend the investments of the Thrift Savings Plan G Fund (otherwise rolled over or reinvested daily, such investments totaled $130 billion in Treasury securities as of May 31, 2013);

- Suspend investments of the Exchange Stabilization Fund (otherwise rolled over daily, such investments totaled $23 billion as of May 31, 2013);

- Suspend the issuance of new securities to the Civil Service Retirement and Disability Fund and Postal Service Retiree Health Benefits Fund (totaling an estimated $79 billion on June 30, 2013, and about $2 billion each subsequent month);

- Redeem early securities held by the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund equal in value to expected benefit payments (valued at about $6 billion per month);

- Suspend the issuance of new State and Local Government Series (SLGS) securities and savings bonds (between $4 billion and $17 billion in SLGS securities and less than $1 billion in savings bonds are issued each month); and

- Replace Treasury securities subject to the debt limit with debt issued by the Federal Financing Bank, which is not subject to the limit (up to $8 billion).

And due to higher tax revenues at the start of 2013, we see that interest payments on government debt weren’t a problem. In fact, the interest payments as a percentage of tax revenue has been declining since 2013 (Chart 2).

|

| Chart 2: Interest payments as a % of tax revenue |

Though, there is one parameter that was not anticipated and that is the effect of higher interest rates and higher mortgage rates.

What is Open Interest?

BrotherJohnF explains open interest here: