Today I was thinking about the yen dropping against other currencies. Mostly, such things happen when governments print money. But also when countries post deficits in their current account balance.

The mechanics are as follows:

A country exports stuff to other countries and receives money in foreign currency. Let’s say Japan exports Playstations to America and receives US dollars. Japan will of course want yen, and will exchange those US dollars into yen so that they can buy things with yen in their own country Japan.

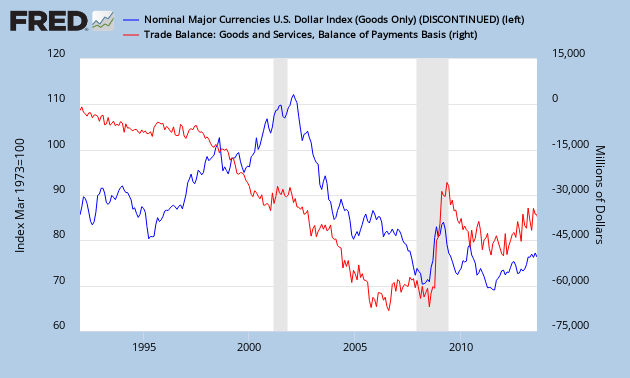

If Japan exports more to the US as the US exports to Japan, then more money will flow to Japan than to the US. So more US dollars flow to Japan as yen flow to the US. Which means more US dollars need to be converted into yen, which makes the yen rise.

Conversely, when Japan has a trade deficit, like today, then the yen will drop against other currencies out there. So basically you want your currency to strengthen, which indicates that your balance sheet is improving.

Strength in currency:

Strength in currency has other positive effects. If your currency is higher than other currencies then you can buy more stuff. Let’s say the oil price is $US 100/barrel. If the yen goes up against the US dollar, the oil price is still the same, but Japanese people can buy more oil, which means their import costs go down, which is good for their balance sheet.

People will say though, if your currency goes up, you will export less. I think this is a complete baloney! When your currency goes up, you can always reduce the prices of your goods that you sell to foreigners. You will have less revenue (because you sold for a lower price), but your currency went up (which means you didn’t lose any money). You will still have the same real revenue as a company, currency adjusted. Of course, when you reduce the price of your goods sold, you should also reduce the wages of your employees, otherwise costs will go up. But the employees shouldn’t have a problem with this, because they still have the same buying power as their currency just went up against other foreign currencies. And if they had money in the bank, that money just went up in value against other currencies.

Generally, companies will benefit though, because their import costs went down due to a strenghtening currency.

Conclusion:

When your currency goes up you will always benefit:

1) You can buy more stuff (oil, food, gold…)

2) Exports will NOT go down as you can always reduce prices of your goods sold, and reduce wages of your employees. Import costs will go down as the currency went up against other currencies.

3) Employees aren’t affected as their reduced wages are compensated by a higher currency. Their buying power stays the same.

4) Savings in their own currency will appreciate in value.

I would love to have a discussion with anyone who doesn’t concur with this thesis.