Shorting the dollar is overcrowded.

Month: June 2021

Bank Loans Vs. QE

According to Yardeni, rate hikes won\’t start until tapering starts.

Tapering (blue line) won\’t start until lending (red line) increases.

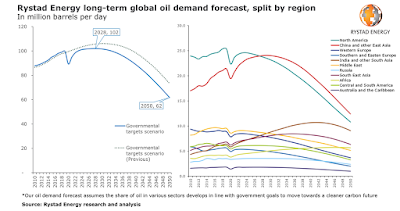

Oil Demand Will Peak

Oil is temporary, copper is forever.

Fed Allows Bank Dividends and Buybacks

The Fed allows banks to buy back shares and issue dividends amounting to $128 billion from July 2021 onwards. Consider the following. A buyback uses cash on the balance sheet of a company to buy back shares, dissolving them and pushing the share price higher. That cash comes into the hands of shareholders and will start flowing into the economy. This in effect is a stimulus to the economy and pushes up asset and consumer prices.

Copper Demand in the Next 25 Years Will Exceed All Copper Demand in History

Global copper stock levels are at all time lows

10 Year Break-Even Inflation Rate Vs. CPI

The 10 year break-even inflation rate = 10 year bond – 10 year tips. It represents a measure of expected inflation and is a leading indicator for the CPI.

Glencore CEO on Commodity Bull Market

Glencore\’s Glasenberg full interview, fast forward to the one-hour eleven minute mark.

Summary:

- Infrastructure spending in both China and U.S.A will boost commodities.

- COVID-19 continues to impact supply.

- Lower grades and more difficult jurisdictions impact supply.

- China stockpile supply is temporary as they need to restock eventually.

- 80% of the world energy demand needs to be replaced from fossil fuels to renewables.

- Renewable energy needs to transition: 3000 GW to 26500 GW in 2050.

- Solar Panels: 20 times more demand.

- Electric Vehicles: 18 times more demand to 55 million electric vehicles.

- Wind Turbines: 11 times more demand.

- Copper: 30 million tonnes of demand per year today. 1 million tonnes per year increase per year needed to arrive to 60 million tonnes of copper per year.

- Nickel: 2.5 million tonnes per year today to increase to 9.2 million tonnes per year.

- Iron Ore: China is pushing their companies to increase iron ore supply for green energy (wind turbines and electricity pylons).

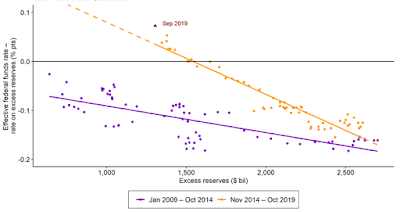

Reserve Balances Vs. IOER

The Reserve Balances at the Fed have been skyrocketing to $4 trillion. The higher this becomes, the higher the IOER needs to be. A hike in IOER is disinflationary as it incentivizes banks to hold more capital at the Fed (IOER serves as a proxy for the fed funds rate).

On the chart below we see that when the excess reserve balance goes higher, either the IOER needs to increase or the Fed Funds Rate needs to decrease.

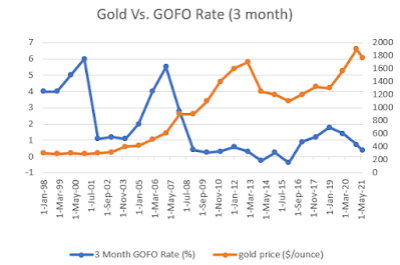

GOFO Rates Vs. Gold Price

Koos Janssen points out that when GOFO rates turn negative, the gold price is pushed up due to tight supply in gold.

I have compiled the 3 month GOFO rate since 2008, calculated from lease rates and libor rates. You will notice that the GOFO rate is quickly turning negative and this tells me that the gold price is probably nearing a bottom rather than a top.