Month: March 2020

Silver Supply and Demand

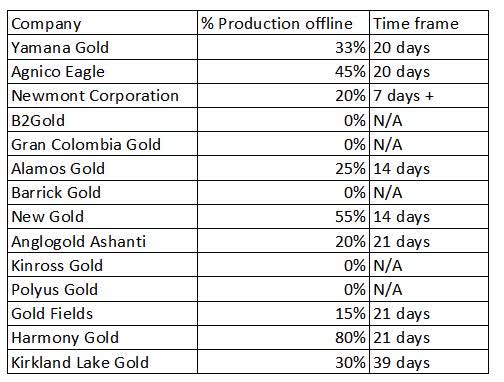

Gold Miners Shutting Down

Gold Miners all over the world are shutting down, this could disrupt supply of gold and should be beneficial to the gold price.

For more information, go here.

As for silver, Mexico (producing 23% of global silver), has also shut down mining for 1 month. I estimate that at least 75% of global silver supply is down based on the chart below.

When QE doesn't work anymore

As the economy is plunging.

The Fed is trying to pump up the market but isn’t succeeding yet.

However, gold will catch up.

Because base money supply is going to skyrocket from $20 trillion to $30+ trillion. That’s a 50% increase. So gold should also go up 50%.

When QE doesn\'t work anymore

As the economy is plunging.

The Fed is trying to pump up the market but isn\’t succeeding yet.

However, gold will catch up.

Because base money supply is going to skyrocket from $20 trillion to $30+ trillion. That\’s a 50% increase. So gold should also go up 50%.

When QE doesn’t work anymore

As the economy is plunging.

The Fed is trying to pump up the market but isn’t succeeding yet.

However, gold will catch up.

Because base money supply is going to skyrocket from $20 trillion to $30+ trillion. That’s a 50% increase. So gold should also go up 50%.

Rhodium: In 1 Week, It Was Gone

Cash is King

Silver Premiums skyrocketing

Investors finally wake up to the disconnect between paper and physical silver. A week ago you could for example buy the PSLV ETF at a discount and take delivery at a premium. That window has now almost closed as premiums are skyrocketing.

U.S. mint sales are booming in March 2020.

SLV stock level in the trust is rising, while the spot silver price is falling. This happened in 2008 as well and the next years, silver made a comeback.

On another note, the commercial silver shorts keep falling (-50% from the top) and open interest is declining to 166682 from 238970. This should be beneficial for the silver price.

Also silver premiums are rising.

Keith Neumeyer says 25% of silver supply from mines is being shut down (Chile, Peru). This is a huge number.

VIX Vs. Margin Debt Gold Selling

One of the reasons why gold is declining together with the stock market is because of margin debt selling. To cover stock losses, investors needed to sell their gold and silver. The VIX shows when this margin selling occured in 2008. Today in 2020 we see a similar spike in the VIX and this might call the top in margin selling again. Each time this happened, easy money started to flow in from central banks and the gold price recovered sharply.