CPI

Working Age Vs. Consumer Price Index

Yardeni describes this perfectly here. Younger people simply spend more than older people and contribute more to GDP and inflation. If we plot the percentage of younger people in society against the inflation rate we have a very nice correlation.

Bonus chart:

Retail Sales Vs. Consumer Price Index

Inflation expectation is rising

Remember, when the CPI goes up and bond yields drop, gold goes higher. And that’s exactly what is happening now. Bond yields are lower and CPI is higher.

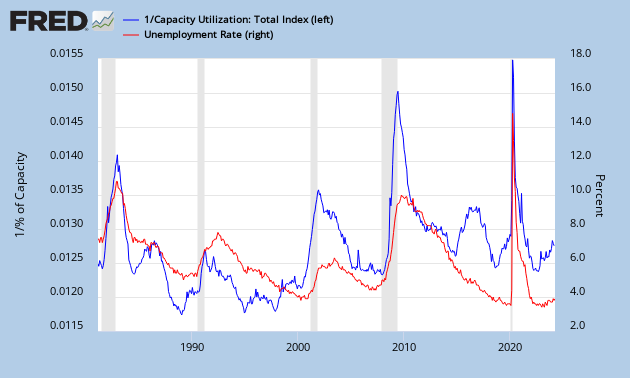

Capacity Utilization Points to Higher Inflation

The chart below points to a year over year CPI rate of 5% in the coming future. And we’re already half to that number as the latest consumer prices pointed to a 0.2% increase in prices in the month of March, or a 2.4% inflation rate per annum.

You can be sure that inflation is coming and you should prepare for that accordingly.

Federal Funds Rate Vs. Consumer Price Index

“The Fed Funds Rate will be kept low when inflation stays at this low level.”

Thus, we chart the Fed Funds Rate against the CPI and get this result.

There is a strong correlation between the Fed Funds Rate and the inflation rate (CPI).

So we expect that an increase in interest rates will only happen when inflation starts to rise. The unemployment rate is not on the radar anymore.

Notice that historically the Fed Funds Rate is higher than the inflation rate (positive real interest rate (above 0%)), but today the Fed Funds Rate is lower than the inflation rate (negative real interest rate (below 0%))

M1 and CPI are Negatively Correlated

A recent article by Henry Bonner of Sprott Global Resource Investment caught my attention. In that article he mentioned Mishka Vom Dorp’s comments about money supply and inflation. One quote from Mishka is the following:

“First and foremost, an increase in the money supply does not directly result in inflation. In fact, the correlation between increases in M1 – money held by the general public – and inflation becomes apparent only when the timeframe is extended beyond a five year period. Over this longer time frame, the correlation becomes almost perfect.”

So I wanted to see for myself if what he says is true. I plotted the change in M1 against the change in CPI.

To my surprise the correlation is completely the opposite. We have a negative correlation here. Whenever the M1 growth increases (blue chart goes up), the CPI growth actually decreases (red chart goes down). The reason for this is probably that deflation is counteracted by the Federal Reserve by money printing and this causes M1 to increase during deflation.

What this means is that inflation will come when the money supply growth actually contracts. We’re in that period since 2012. So why is the red chart down since 2012? It’s because inflation has been visible in stocks, but stocks are not included in the CPI. But I believe we will see a flow from stocks to the consumer in 2014. Everything will normalize again to validate this (negative) correlation.

What Mishka says is true, there is indeed a delay between M1 and the CPI. By monitoring the change in M1, we can accurately predict the CPI. This is a very powerful tool indeed as this is a leading indicator. And as this correlation suggests, you should buy gold when the CPI goes up.

For the entire article, see below:

By Henry Bonner (hbonner@sprottglobal.com)

During a historic boom in equities, gold and gold equities have sunk to new lows with the GDX returning negative 55% over the past year. Why have gold and other precious metals fared poorly while other equities, such as those composing the S&P 500, have seen average annual returns of nearly 30%?

Mishka Vom Dorp, who joined Sprott Global Resource Investments Ltd. in 2008, explained why he believes precious metals have sunk – and where they are headed next.

“With government debt, unfunded liabilities and the money supply reaching all-time highs, surely the gold price should be increasing as well?

“The answer is, I believe, that in the short term, gold has not yet had time to react fundamentally. Whether you follow the official government CPI figures or alternative methods of computing inflation, we have yet to see the double digit inflation figures of the 70’s. There are two explanations that I believe are responsible for the lack of inflation that we see now but that we might see in the future.

“First and foremost, an increase in the money supply does not directly result in inflation. In fact, the correlation between increases in M1 – money held by the general public – and inflation becomes apparent only when the timeframe is extended beyond a five year period. Over this longer time frame, the correlation becomes almost perfect.1

“Secondly, two thirds of the freshly printed greenbacks have not been released into circulation and are being held directly at the Fed in what are called ‘excess reserves.’2

“The Fed has, so far, incentivized banks to keep cash there instead of lending it out by paying interest on the reserves. Remember that the amount of un-lent capital held at the Fed is increasing on a year-to-year basis and rising interest rates would cause those reserves to snowball. The Fed will eventually have to cut interest payments on excess reserves, thus releasing a large amount of capital into the financial system, leading to inflation if not enough GDP growth is there to accommodate the influx of new dollars.”

So rising interest rates could bring current levels of excess reserves down and boost inflation if the economy fails to deliver sufficient growth. Inflation may therefore rear its ugly head after all… As Mishka concludes, now is not the time to dump gold and precious metals equities.

“With a dwindling supply of juniors, continuing write-downs on assets by majors, and a continuing of easy money policies, I believe we are close to finding the elusive bottom to this bear market.

“The longer the bear market, the stronger the bull. Investments in exploration and development of mineral deposits have fallen massively over the past three years. Mineral exploration is an extremely capital intensive business requiring billions of dollars in investments to find and develop large scale mines. With majors cutting their budgets across the board to bring down costs demanded by investors, it has been left to the juniors to ensure discoveries are made to meet current and future demand.

“Now that only a handful of competing resource investors are still around, we will have the ability to research, finance and invest in what we believe are the best companies without the need compete with an eager market.

“I would be devastated to have sat through this bear market this far with you only to have missed out when the picture finally shifted in our favor.”

Art Prices Predict CPI

From Kingworldnews:

According to Austrian Business Cycle Theory the prices of capital goods (= asset price inflation) increase first in the course of an inflationary process, while consumer price inflation (= rising consumer prices) only ensues later. The asset price inflation that is currently in train can be identified by a multitude of symptoms. Prices for antiques, expensive wines, vintage cars, but also real estate and especially stocks recently increased strongly.

Consumer Price Index: The effect of a rise in oil prices

|

| CPI |

So basically, if oil prices go up 20%, the CPI at least goes up 2% from the fuel in the housing and transportation segments (if all else stays equal). The other segments will of course be influenced too by rising oil prices, but to a lesser extent.

So that’s the significance of the oil price on the CPI.

Initial Jobless Claims starting to rise, S&P in for a correction

This week’s initial jobless claims were rising again as reported by Zero Hedge and based on the obvious correlation between the S&P and initial jobless claims here, I expect that the S&P will come down eventually.