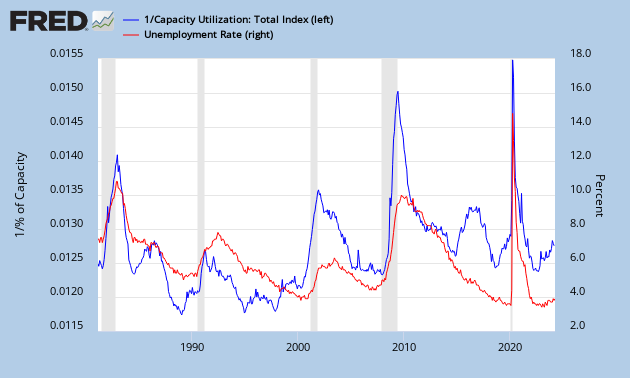

Obviously, the U.S. unemployment rate is not a good measure anymore for the state of the U.S. jobs market. Ever since the crisis started in 2009, the labor force participation rate has declined, so the jobs market was not improving. Recessions occur when the labor force participation rate drops, which means we’re in a recession since 2008 and have not gone out of this recession at all.

The U.S. unemployment rate should have soared to 10% at least, when counting all the people out of the labor force and this correlation proves it. Also, if next quarter has negative GDP as well, then we are officially in recession, which is very plausible, considering the decline in the labor force participation rate.