Khan

How to Monitor the Labor Force Participation Rate

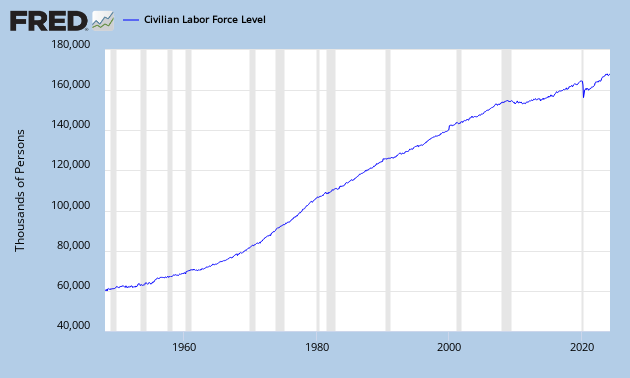

A Zerohedge article made me think about the unemployment rate. Apparently, year over year, the civilian population rose while the labor force declined. You might say: “What does this mean?”.

Let’s first look at this informative video from Salman Khan:

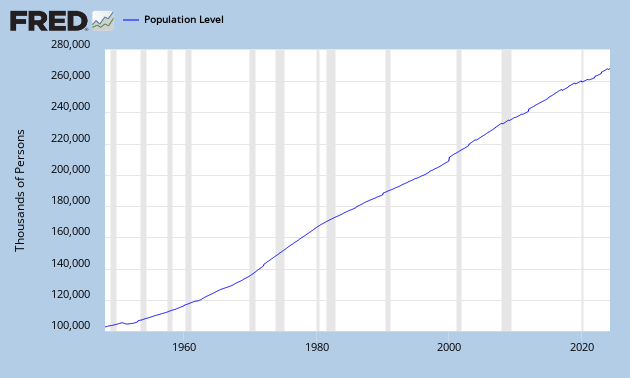

The yellow circle is the civilian population, people older than 16+ years, which can be found here:

Capacity Utilization update

The Capacity Utilization rate in the US for total industry (Dec 2011) was released today at 78.1%. This means that we’re still in an uptrend, which is bullish on gold and silver.

Speaking about silver: PSLV (Sprott’s silver trust) today dropped almost 10% today, I’d say this is a very good price to start accumulating physical silver.

|

| Capacity Utilization (BullandBearwise) |

Historically when capacity utilization rates go to 80%, a year later we get a spike in inflation. So there is a high correlation between capacity utilization and inflation.

If you don’t know what capacity utilization is, you can follow these two videos from Salman Khan on the capacity utilization – inflation correlation here: