Gold and silver lease rates are correlated to the premiums.

Lease

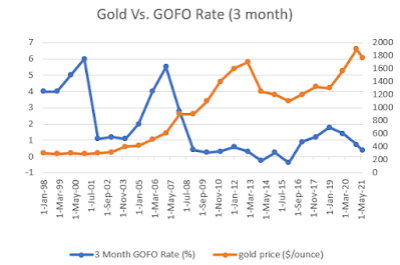

GOFO Rates Vs. Gold Price

Koos Janssen points out that when GOFO rates turn negative, the gold price is pushed up due to tight supply in gold.

I have compiled the 3 month GOFO rate since 2008, calculated from lease rates and libor rates. You will notice that the GOFO rate is quickly turning negative and this tells me that the gold price is probably nearing a bottom rather than a top.

Backwardation in Lease Rates Vs. Silver Price

Lease rates on itself can also have backwardation whenever the lower maturity rates are higher than the higher maturity rates which you can see in the chart below.

Gold miners hedging Vs. Gold lease rates

In the year 2000, everyone was hedging gold, because the gold price kept falling. Gold lease rates peaked in 2000.

After 2000, the gold price went up and hedging decreased. When the price of gold rises, gold miners typically decrease their gold hedging, because they want to profit from the rise in gold. The decrease in hedging led to a decrease in lease rates.

Backwardation in Gold: GOFO = LIBOR – GLR

This is stated as a percentage, and is almost always positive, meaning the gold price for future delivery of gold is higher than the current spot price. If the GOFO is negative, this means that it is cheaper to borrow against gold than dollars, and is very unusual. Generally speaking, it should be cheaper to borrow dollars for just dollars, without involving another commodity, however the GOFO has turned negative on several occasions in the past due to periods of high physical demand.

So what is the status today?

Gold Lease Rates are negative -2% and we even had spikes to -4%.

LIBOR rates are close to zero. 3 month LIBOR is at 0.3%.

That makes GOFO = 0.3% – (-2%) = 2.3%

GOFO is now almost in backwardation and that should tell us that there is a looming physical shortage.

Gold Lease Rates Negative

Palladium lease rates signal shortage

JP Morgan is fleeing and reducing eligible palladium stock at the COMEX.

When this shortage persists and automakers won’t have access to palladium anymore, they won’t be able to produce cars, because they simply don’t have palladium anymore.

So what do you think they will do when this happens? Answer:

Platinum is going to shoot past $1000/ounce as I predicted.

Gold lease rate spikes

Gold Lease Rates Topping Out

Gold Lease Rate Higher, Registered COMEX Gold Lower

Just another update.

Gold Lease Rates are at an all time high again:

| Chart 1: Gold Lease Rate |

COMEX registered gold has once declined to even lower levels. J.P. Morgan unloaded its registered gold. Total registered gold at COMEX now stands at: 875713 troy ounces. We are nearing the bottom.

|

| Chart 2: COMEX gold |