Premiums have fallen from 35% to 20%.

premium

Junk Silver Premium: 42%

Update on silver premiums

Junk silver premium at new high APMEX

30% premium now, the highest since I monitored it. If this quickly goes to 50%, would you say the bottom is in?

http://www.apmex.com/product/24/90-silver-coins-1-000-face-value-bag

Gold/Silver Premiums Update

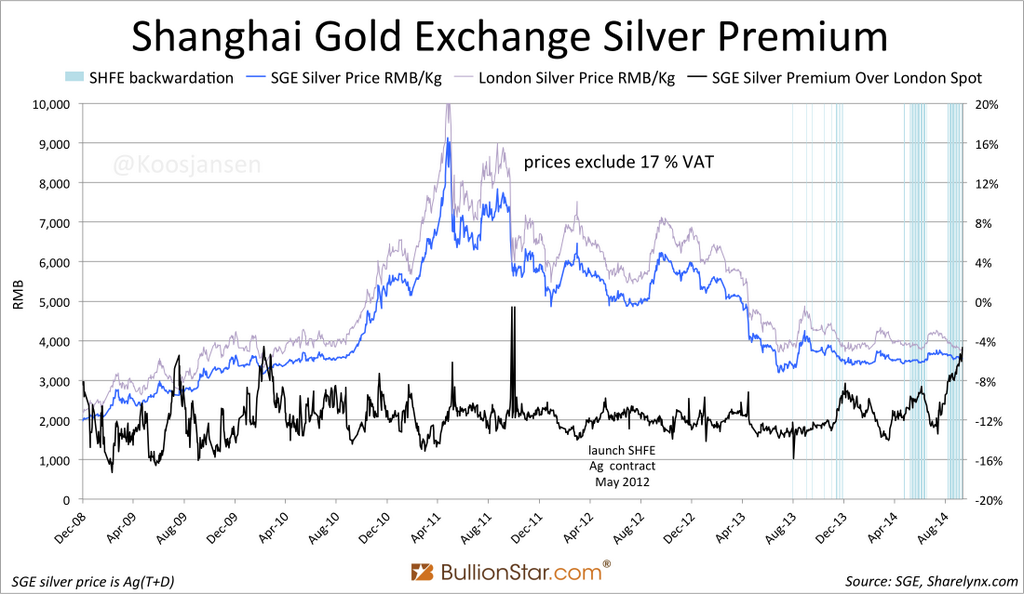

Silver premiums are going to hit new highs in the coming weeks, both at APMEX, silver miners and Shanghai.

APMEX Silver Premiums Soar

But this is only temporary, as Shanghai silver premiums are showing a decline from 14% to 7%.

Shanghai gold premiums even went negative.

Gold premiums on Apmex are pretty normal and even declined a bit.

First Majestic Silver Decreases Silver Premium For First Time In A Year

This is also not consistent with what they said a few weeks ago, namely betting on a higher silver price in the fourth quarter, thus retaining a large amount of their silver inventory stock for the sake of selling it at a higher price in the future.

In fact, a week ago the CEO encouraged other silver miners to halt their silver sales, how will lower premiums accomplish that goal?

Gold/Silver Update

If you look at the premiums, you can see easily that the dealers aren’t dropping their prices even though the paper price is dropping.

Surprisingly, the gold/silver miners did drop. I see this as a buying opportunity.

Gold and Silver premium update

Even though silver dropped to its low of $18.7/ounce, miners have not dropped prices of silver bullion. The result is a record high premium to get your hands on physical silver. It’s amazing that these silver producers won’t drop their selling price. For months we have had a selling price of $23/ounce.

APMEX silver premiums are steady.

Junk silver premium is bottoming out.

Shanghai silver premiums are soaring to almost 13%. If this goes to 20% (above the 17% VAT tax) we will see arbitrage opportunities.

Remember, this 13% premium is the highest since 2008.

|

| BullionStar.com |

While Shanghai gold premiums are zero, but rising! That means China could start raiding the GLD again and we see that GLD reported very low stock numbers recently.

APMEX gold premiums are up again.

Shanghai Silver Inventory Vs. Shanghai Silver Premium

|

| Chart 1: Shanghai Silver Inventory |

|

| Chart 2: Shanghai Silver Premium |

Click on “weekly inventory” (by the way, these are real physical inventories, not imaginary inventories from the LBMA).

For example: 5-Sep-2014: Inventory of silver is 93304 kg.